Home

Gallery

Contact

Events & Projects

Projects: 2019 On

Film & TV

Archive & Links

Home

Gallery

Contact

Events & Projects

Projects: 2019 On

Film & TV

Archive & Links

Home

Gallery

Contact

Events & Projects

Projects: 2019 On

Film & TV

Archive & Links

Home

Gallery

Contact

Events & Projects

Projects: 2019 On

Film & TV

Archive & Links

|

|

Gallery Of Glass For Sale - Ordering, Postage, Payment, Import Duty and Personal Safety Details

Ordering, Postage and Payment:

24th April 2023: We are now using Square as a payment facilitator.

All vessels are individually numbered. Please contact us, quoting the vessel number, to place your order and to arrange payment (email is quickest).

Our prices are ex-works, and in £ sterling (GBP). We do not offer discount for quantity. Packing and delivery charges will be added, based on parcel dimensions and weight.

Any prices on our websites that are not in £ sterling (GBP) are for guidance only. For conversions to other currencies, please visit a financial website such as xe.com. Exchange rates change on a daily basis, and companies such as Square will apply the rate current at the time of purchase.

We are not VAT registered.

We will request payment before delivery. We will inform the customer when the order is ready to ship and to arrange payment.

We accept Faster Payments (free in the UK and payable online) and IBAN. We will supply our bank details. We ask customers to pay any bank payment charges.

We also accept payment via Square - we will send a Square invoice which will include a payment link. A Square account is not needed for payment, and debit and credit cards can be used.

We are not able to offer credit card payment facilities, but credit cards can be used via Square.

We use strong, double-walled cardboard boxes for packaging, and wrap the glass with plenty of bubblewrap. We do not supply gift packaging.

We use Parcel2Go to book most collections, both nationally and internationally, and they supply us with a selection of carrier services depending on parcel dimensions and weight. The carriers include DHL, DPD, Evri, FedEx, Parcelforce, Royal Mail, and UPS, together with national services such as USPS, Canada Post and Australia Post.

12th January 2026: We now use Royal Mail / Parcelforce for all parcels to the USA (see below for details).

Any Import Duty to be paid by the customer (DDU - Delivery Duty Unpaid). Please take this into consideration when ordering. The only exception to this is for parcels to the USA, for which we have to pay the duties (DDP - Delivery Duty Paid) - see below.

Import Duty Information (European Union):

|

EU customers will have to pay Import duty and Import VAT at their country's local rate, even though we are not VAT registered. Information is from this page on the EU Access2Markets website (Product HS Codes 70132210, 70133751, 70134110, 70134991 and other similar codes.)

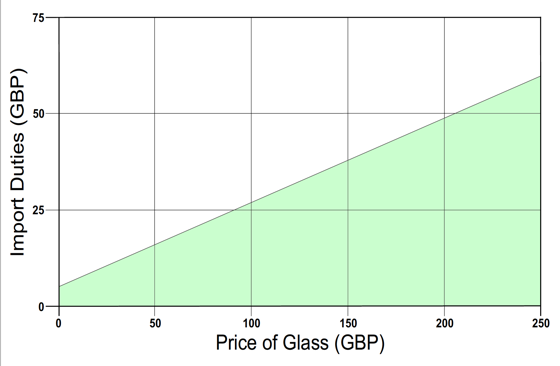

It also appears that a small charge will be levied by the courier (which also attracts VAT) for the collection and handling of the VAT (when import duties came into force, Parcelforce charged a customer of ours living in Germany a 6€ collection fee, including VAT). This graph shows the approximate duties payable on a given value of our glass (expressed in GBP). |

Import Duty Information (USA):

All parcels, regardless of value, origin, or transport method, are now subject to full US customs duties, taxes, and fees.

We now use Royal Mail / Parcelforce for all deliveries below the value of USD800 to the USA as they only charge 10% customs duties on the value of the goods plus an administration fee of £0.50

When we book a collection, we have to pay these duties (DDP - Delivery Duty Paid), and we will pass the charge on to the customer.

Import Duty Information (Canada):

In total, a customer based in Canada may expect to pay around 12% - 16% tax in total, depending on the Province, and based on the value of the glass (but not including the cost of carriage, etc.).

Goods up to the value of CAD20 are exempt, as are gifts up to the value of CAD60.

Depending on the type of goods imported, above these values, Canadian customers will have to pay duties on the total value of the goods imported. These are collected by the Canada Border Services Agency (CBSA) on behalf of the Canadian Government.

Information is available on the CBSA website.

Import Duty Information (Australia):

This has been written using information from the website of the Australian Government, Department of Home Affairs: see this page.

Goods with a declared or assessed value equal to or less than AUD1000 (c.£550 - £600):

For goods imported through air or sea cargo or international mail that are worth equal to or less than AUD1000 (low value imports), there are no duties, taxes or charges to pay (unless it includes goods such as tobacco or alcohol), and cleared goods arriving by international mail will be delivered to you by Australia Post.

If these goods arrive in Australia by air or sea cargo, they must have a Self-Assessed Clearance (SAC) declaration. This will generally be taken care of by the cargo company or freight forwarder. You are not charged for this declaration.

Goods arriving by international mail do not require a SAC declaration.

Note: When goods are assessed for value, you may be asked for evidence as to the value of the goods. In this case, you will receive a letter requesting you to provide evidence to substantiate the declared value.

If the declared value of your goods is accepted, your goods will be delivered to you by Australia Post.

If the declared value of your goods is not accepted, you will be sent a First Notice by Australia Post advising that you will need to lodge an Import Declaration for the goods.

Goods with a declared or assessed value of more than AUD1000 (c.£550 - £600):

For goods that are worth more than AUD1000, you will need to fill out an Import Declaration form, and pay duties, taxes and charges.

If the goods you have imported have a declared or assessed value of more than AUD1000, you will be sent a First Notice.

The Import Declaration will be assessed for duty and taxes and an import processing charge will also be applied. After you have lodged your Import Declaration, you will be advised of the amount you need to pay before your goods can be delivered.

Goods with a value over AUD1000 are unable to be to be delivered by Australia Post unless an Import Declaration is made and any duty, taxes and charges owing are paid in full.

See this page for current tariff classifications, Reference No.7013. Lead crystal glass appears not to attract duty, whilst other glass (e.g., soda-lime glass) appears to attract a duty of 5%.

If you are contemplating an order totalling over AUD1000, then it may be worthwhile considering splitting the order into two or more units of less than AUD1000.

Personal Safety:

We pack our glass vessels using bubblewrap and double walled cardboard boxes. However, we do have the occasional breakage occurring in transit. Please bear this in mind when unpacking your glass and proceed carefully.

Each glass vessel will have a pontil or 'punty' scar at the centre of the base, or on the underside of the foot. As we are reproducing historical glass of the 18th century and earlier, we do not grind and polish it away. Instead we make it safe by running a small steel rod around the sharp edges of the scar. Occasionally we may miss an area, so carefully check that the scar has no sharp edges. If there are any, they are easily dulled and made safe by running, for example, a small screwdriver around them.

Our reproduction 18th century colourless glasses and decanters are made from 30% lead crystal. This includes the Outlander colourless glasses and decanters. Information on lead in glass can be found here on our website. Leaching of lead does appear to be minimal from wine glasses during normal use, but we would recommend that liquids (particularly acidic liquids) are not stored in decanters. Note that there is no lead in our reproduction dark green glass bottles, nor in our other reproductions (Roman, etc.) unless opaque white, opaque yellow or opaque red glass has been used.

Care of Handmade Glass:

The best and most effective method of caring for handmade glass is to wash it by hand using washing up liquid in lukewarm water.

The detergents used in dishwashers can attack the surface of glass, particularly at high temperatures, causing eventual clouding. Hot washing and drying cycles should be avoided as sharp changes in temperature can lead to breakage due to thermal shock.

We would recommend that our glass is washed by hand and not by dishwasher.

Finally:

In the case of breakage in transit, we will offer to refund the cost of, or to replace the broken glass vessel(s). Please note that as each potful of molten glass is different, we cannot guarantee that a replacement vessel will have exactly the same colour tint as the vessel it is replacing.

Home Gallery Contact Events & Projects Projects: 2019 Onwards Film & TV Archive & Links